1 / 1

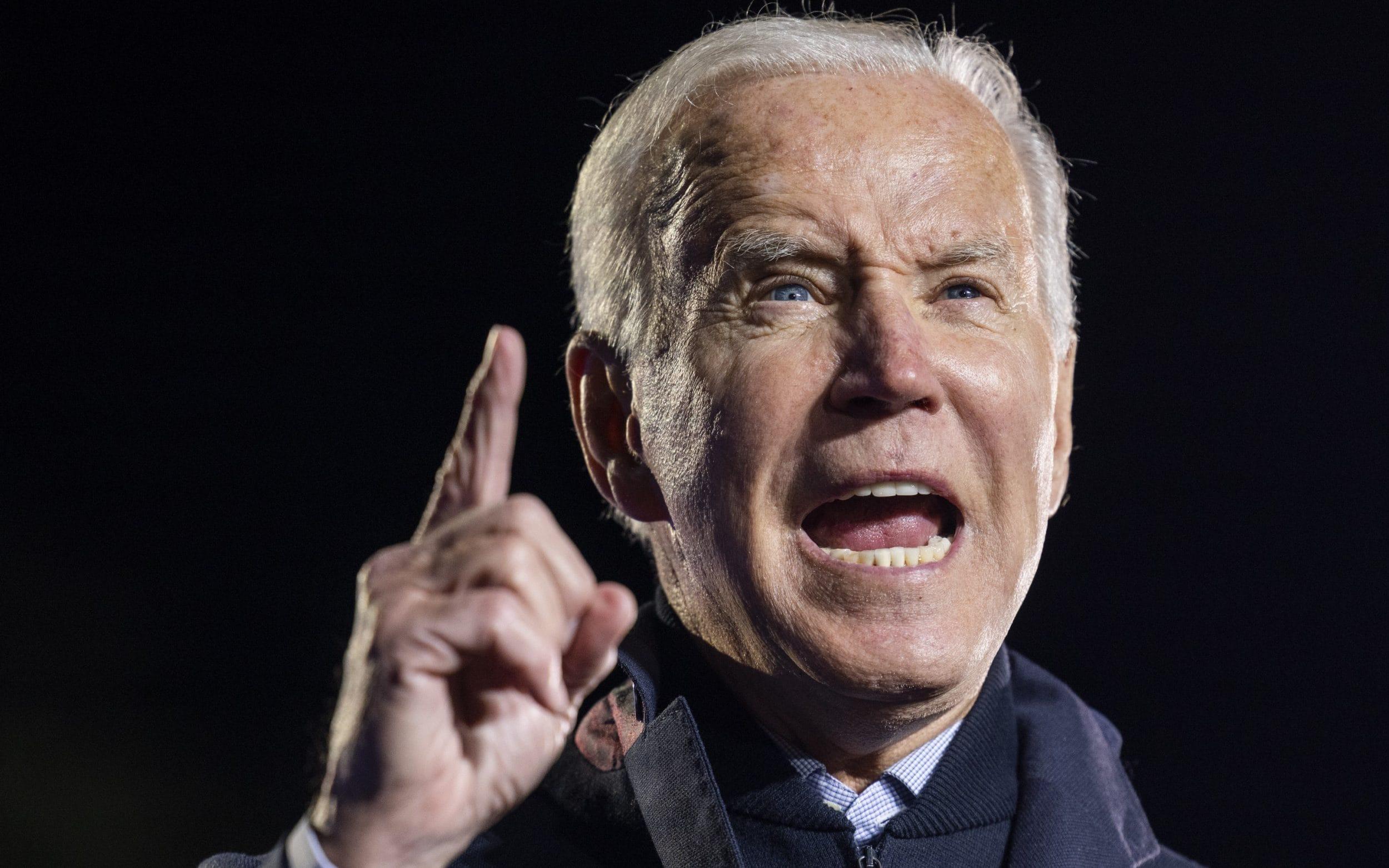

Biden considers taxing billionaires and the very rich

To fund the economic stimulus, Biden considers taxing billionaires and the very rich

The Democratic administration is offering a new tax on unrealized capital gains. The proposal targets individuals with more than $1 billion in assets or more than $100 million in income over three years, according to the Wall Street Journal.

The subject has been a hot topic for several months in the United States but the federal government must urgently find new tax revenues, first to finance the pharaonic post-Covid recovery plan sought by Joe Biden (up to 3.5 trillion dollars), then to definitively avert the risk of default on payments that hangs over public finances. While Joe Biden can boast of having reduced the public deficit, despite the emergency spending linked to Covid-19, the economic recovery is proving to be more fragile than expected (the IMF having lowered its growth forecast to 6% in 2021). With supply disruptions and the ongoing semiconductor crisis, Washington may not be able to count on the revival of household consumption and corporate profits for long. The idea would be to tax so-called “latent” capital gains, i.e., to tax the dormant gains in the thick stock portfolios of America’s great wealth. This would make Republican elected officials and some of the more conservative Democrats in Congress sit up and take notice. « We’ll probably have a tax on the rich,” House Democratic Leader Nancy Pelosi announced on CNN.

200 billion in tax revenue over 10 years

The proposal targets people with more than $1 billion in assets or more than $100 million in income over three years, or fewer than 1,000 U.S. taxpayers, according to the Wall Street Journal. Other media outlets report that there are about 700 billionaires. Today, a wealthy shareholder like Tesla’s Elon Musk or Amazon’s Jeff Bezos does not pay taxes on these unrealized gains because they do not exist until they are actually cashed in.

According to Pelosi, this tax could generate at least $200 billion in revenue over a decade, far from the more than $3 trillion in spending over 8 to 10 years that Joe Biden wants to reform America.

“The “Build Back Better” plan for social and climate measures remains at $2 trillion over 10 years and the plan to modernize infrastructure is $1.2 trillion. U.S. Treasury Secretary Janet Yellen acknowledged on the same channel that “this would make it easier to reach capital gains, which represent an extremely important part of the income of the richest people and which are currently not taxed. Since the announcement of its stimulus plans, the Democratic administration has been looking for new tax revenues. Crypto-currencies, whose capital gains generated are also in the sights of tax collectors, are currently awating regulation.